38+ do you have to pay mortgage insurance

A Rated Term Policies From 738Month. The federal Homeowners Protection Act gives you the right to remove PMI from your home loan in two.

July Ebook Pages 88 172 13 1 Mb Latitude 38

Ad Home Insurance with Great Coverage.

. Or you can pay mortgage insurance each month. Bundle with Auto to Save More. Web In either situation the mortgage insurance is an extra cost in addition to your monthly mortgage payment and it usually costs between 05 and 1 of the value of your home each year.

Private mortgage insurance premium rates vary based on the loan-to-value ratio on the home your credit. And remember even if you. Typically borrowers making a down payment of less than 20 percent of the purchase price of the home will.

No Medical Exams No Wait. If you do you only pay mortgage insurance until you owe less than 80 of the Homes value. Ad Compare Top 5 Mortgage Life Insurance 2023.

Web Other loan programs may have their own forms of mortgage insurance. Web Last Updated on March 3 2023 by Luke Feldbrugge. The VA loan PMI benefit is one of the money-saving advantages of working with the VA loan system on your mortgage.

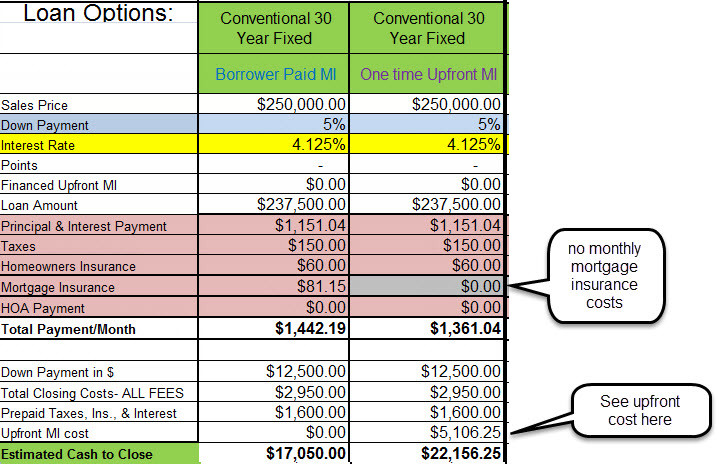

Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. For our example home that costs 285700 MI payments of 1 could. Your PMI cost is paid in full at closing.

Web When a lender issues you with a mortgage the lender wants some sort of compensation for the risk its taking. Web 4 ways to get rid of PMI. For refinance loans your loan-to-value ratio is over 80.

You only pay upfront PMI once which means you wont have any ongoing monthly mortgage insurance costs. Web If youre getting a conventional mortgage and your down payment isnt up to the 20 mark youll need to pay for a private mortgage insurance PMI policy. Web If youre ready to buy a home shop around to find loan options and offers from different mortgage lenders.

Ad Check Your VA Loan Eligibility for 0 Down No PMI and Lower Monthly Payments. On FHA loans mortgage insurance is referred to as a mortgage insurance premium MIP. Top 5 Life Insurance of 2023.

Web If you bought a home with a down payment that is less than 20 of the purchase price or if you refinanced with less than 20 equity your lender will require you to purchase mortgage insurance. 100 No-Hassle Online Process. Youll end up with a lower monthly payment.

Pay down your mortgage for automatic or final termination of PMI. Once you owe 80 or less. PMI is private mortgage insurance and new home buyers often need to pay.

Web Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get. When youre signing up for 300000 or more of debt having that all handled for a flat fee is awesome. Companies are required by law to send W-2 forms to employees by Jan.

Web 2 days agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web The upfront charge is 175 of the loan amount and the annual premium is either 85 or 80 depending on the down payment. Compare the total cost including the closing costs interest and mortgage insurance to find the option that will work best.

Once youve reached 20 equity in the home you may be able to get rid of your. Web You pay a flat-rate premium every year that you have your mortgage. You can reassure the bank that you have skin in the game by putting at least 20 down.

If you die the mortgage is paid off. Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. If you put down less than 10 the annual mortgage insurance payment or MIP is paid in monthly installments for the.

Web If you cant afford to put down at least 20 on a purchase you may have to pay for PMI. Its important to note that not all loan programs will. But the fee stays the.

Ad Check Your VA Loan Eligibility for 0 Down No PMI and Lower Monthly Payments. Web Unlike government loans conventional loans only require mortgage insurance if you make less than a 20 down payment. Get Free Quotes Save Now.

MIP is required on all FHA loans and comes with both an upfront premium and an annual. Insure Your Home Today. Web Lenders often require you to pay your insurance premiums property taxes and mortgage insurance fees through an escrow account if your down payment is 20 or less.

Since your entire PMI premium is paid at closing your. 31 each year and. If youre refinancing your current mortgage most conventional lenders require an LTV ratio of 80 or less to avoid having.

The Ds3 Group Moneyworks Financial And Health Solutions Houston Tx

A Guide To Private Mortgage Insurance Pmi

Private Mortgage Insurance Pmi When It S Required And How To Remove It

Mortgage Insurance What It Is And When It S Required Forbes Advisor

Zero Point Mortgage Services Mortgage Brokers You Can Trust

Fargo Moorhead Mortgage Company Get Pre Approved To Buy A New Home

Prompt Realty Mortgage Inc Har Com

How Much Is Mortgage Insurance Pmi Cost Vs Benefit

What Is Mortgage Insurance Learn About Pmi And Mip Citizens

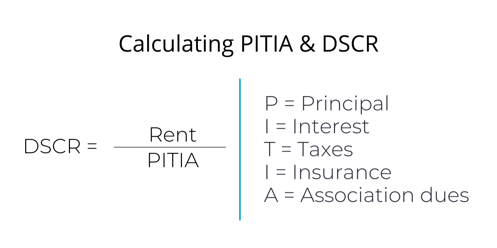

Dscr Loans Visio Lending

What Are The Pros And Cons Of A Conventional Loan Quora

What Is Pmi How Private Mortgage Insurance Works Nerdwallet

Do I Need Mortgage Insurance Smartasset Com

How I Purchased My First Home At Aged 21 My Top Five Tips

.png?width=500&height=357&name=DSCR%20LP%20Graphics%20(1).png)

Dscr Loans Visio Lending

Why Am I Required To Pay Private Mortgage Insurance Pmi Realitycents

Marketing Letter Template 38 Free Word Excel Pdf Documents Download